Power purchase agreements (PPA)

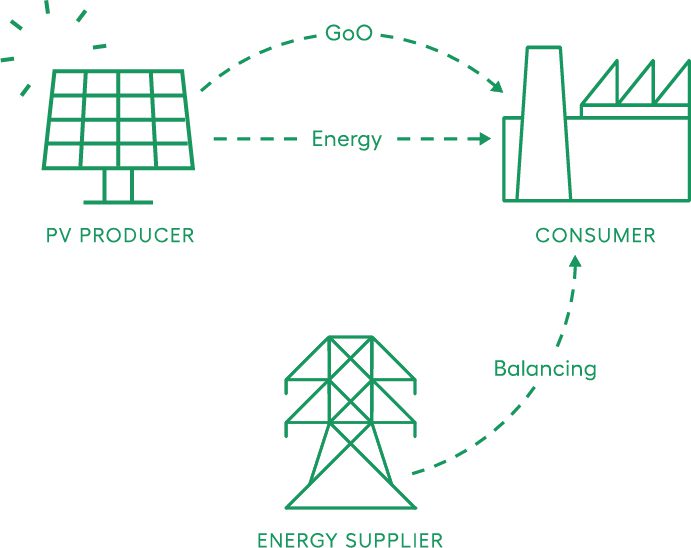

A direct, tailor-made contract between a renewable energy producer and a large-scale energy consumer to procure clean energy at attractive prices while adhering to best practices in governance.

The offtaker contributes to the creation of new green assets through commercialization, enabling over 3TWh of energy and 500 MW of renewable assets with R.Power PPAs across multiple markets